Do home warranties cover stucco: 3 Truths Revealed

Why Understanding Stucco Coverage Matters for Your Home

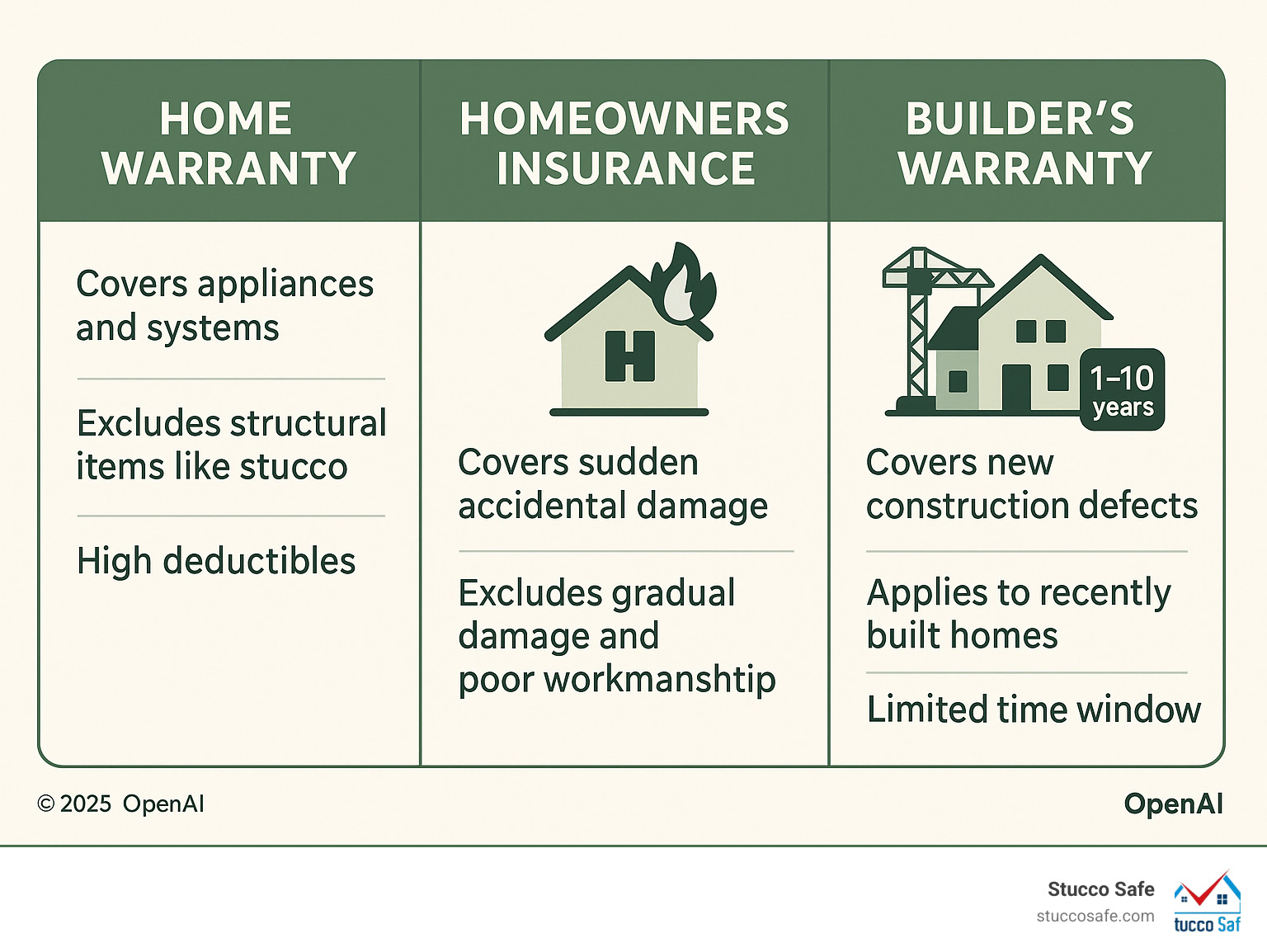

Do home warranties cover stucco repairs? The short answer is rarely. Most home warranties exclude structural components like stucco, focusing instead on appliances and mechanical systems. This misconception can lead to expensive surprises, as stucco remediation can cost tens of thousands of dollars.

Quick Answer:

- Home Warranties: Usually exclude stucco (structural component).

- Homeowners Insurance: May cover sudden damage from storms, fire, or vandalism.

- Builder’s Warranty: Covers defects in new construction for 1-10 years.

- Best Protection: Professional inspection to identify issues early.

Homeowners often have three types of protection: home warranties, homeowners insurance, and builder’s warranties. Each serves a different purpose and has vastly different rules about stucco coverage. Most stucco damage falls into categories that warranties specifically exclude, such as:

- Gradual water intrusion

- Poor installation or workmanship

- Normal wear and tear

- Pre-existing conditions

- Cosmetic issues

I’m Gabe Kesslick, and through my work with Stucco Safe since 2001, I’ve seen countless homeowners realize that asking do home warranties cover stucco was the wrong first question. Understanding all your protection options is the key.

Learn more about do home warranties cover stucco:

The 3 Types of Stucco Protection: Warranty vs. Insurance

When stucco problems appear, homeowners often struggle to figure out who pays for repairs. The confusion is understandable, as there are three different types of protection that might apply, each working differently.

Do home warranties cover stucco? Almost never. To understand why, know what each type of protection actually does.

| Type of Protection | Primary Purpose | Typical Stucco Coverage | Common Exclusions |

|---|---|---|---|

| Home Warranty | Covers repair/replacement of home systems and appliances due to normal wear and tear. | Extremely limited; generally excludes structural components like stucco. | Improper installation, pre-existing conditions, lack of maintenance, structural damage, cosmetic issues, gradual water intrusion. |

| Homeowners Insurance | Protects against sudden, accidental damage from covered perils (e.g., fire, storms, vandalism). | May cover stucco damage if caused by a sudden, covered peril, but not wear and tear or poor workmanship. | Gradual damage, maintenance issues, pre-existing damage, faulty construction, mold (often), earth movement. |

| Builder’s Warranty | Covers defects in new construction materials and workmanship for a specific period. | Covers stucco defects (materials/installation) for 1 year; major structural defects for up to 10 years. | Normal wear and tear, homeowner neglect, damage from weather or natural use (unless due to defect), minor cracks, homeowner modifications. |

The key is understanding which coverage you have and what it covers. Most stucco problems fall into categories that warranties specifically exclude. More info about stucco problems.

Home Warranty: A Service Contract for Systems and Appliances

A home warranty is a service contract for your appliances and home systems. When your water heater or air conditioner fails from normal use, you pay a service fee (usually $75-$150), and the warranty company sends a technician.

Home warranties focus on mechanical systems: HVAC, plumbing, electrical, and major appliances. They consider stucco part of the home’s structural envelope, which is not covered. Even if a policy mentions exterior components, the coverage is usually minimal, with high deductibles and low coverage caps that make claims for major stucco repairs impractical.

Homeowners Insurance: Protection from Sudden & Accidental Damage

Homeowners insurance is your safety net for disasters. It protects against sudden, accidental damage from covered events like fires, storms, or vandalism. For stucco, this means a hailstorm or a fallen tree might be covered.

However, homeowners insurance excludes maintenance issues, gradual damage, and poor workmanship. If your stucco is failing due to slow water intrusion from improper installation, your insurance company will deny the claim. They pay for accidents, not construction problems or neglect, which cause most stucco failures.

Builder’s Warranty: Coverage for New Construction Defects

If you bought a new home, a builder’s warranty is your best bet for stucco coverage. These warranties typically cover workmanship and material defects for one year. If your stucco was installed incorrectly, the builder should fix it within this period.

For major structural defects resulting from stucco failures, coverage can extend up to 10 years. This recognizes that some construction problems take time to appear. The catch is that these warranties only apply to new construction and have strict time limits for reporting issues.

Do Home Warranties Cover Stucco? The Complicated Answer

Do home warranties cover stucco repairs? The answer is almost always no. Home warranty companies are in the business of fixing appliances, not exterior walls. Their contracts are focused on systems and appliances—things with moving parts or that circulate air and water.

Stucco is considered a structural component, which falls outside their standard coverage. When you examine a home warranty contract, you’ll find that structural items like stucco are either absent from coverage lists or buried under numerous exclusions. The language is designed to protect the warranty company from the expensive, complex world of exterior wall systems.

Even if a policy hints at exterior coverage, policy limitations are often deal-breakers. Coverage caps might pay for a small patch but won’t cover a full remediation costing $30,000 or more. Combined with high service call fees, the “coverage” becomes impractical.

Common Exclusions in Home Warranty Stucco Coverage

Home warranty companies use precise exclusion language, and stucco damage often falls into these categories:

- Improper installation: This is the most common exclusion. Since most stucco problems stem from installation errors (missing moisture barriers, improper flashing), this eliminates most claims.

- Poor workmanship: If the stucco wasn’t applied correctly, it’s considered a construction flaw, not a covered failure from normal wear and tear.

- Lack of routine maintenance: Warranty companies expect you to seal cracks and maintain caulking. If a small, unaddressed crack leads to a bigger problem, they can argue it’s neglect.

- Pre-existing conditions: If there’s evidence the problem existed before your warranty began, the claim will be denied. Proving when slow-developing stucco damage started is nearly impossible.

- Gradual water intrusion: Most stucco damage comes from moisture seeping in slowly over months or years. This slow-motion failure is exactly what home warranties are designed to avoid.

- Cosmetic issues vs. structural failure: Small cracks or discoloration are often dismissed as cosmetic, even if they signal underlying issues. You must prove the damage affects the home’s structural integrity.

Why a stucco inspection is worth it: Why a stucco inspection is worth it.

How to Compare Home Warranty Plans for Stucco

If you’re determined to find a home warranty with potential stucco coverage, here’s a practical approach:

- Review contracts with a fine-tooth comb: Ignore marketing materials. Read the actual contract, focusing on structural coverage, exclusions, and specific mentions of siding or stucco.

- Check the exclusion lists first: Go straight to the “what we don’t cover” section. This will quickly tell you if stucco coverage is even theoretically possible.

- Look for optional structural add-ons: These are rare and can be expensive. If you find one, scrutinize its coverage limits, exclusions, and fees.

- Research provider reputation: See how different companies handle structural claims. A provider known for denying claims isn’t worth your money.

- Understand coverage caps and service fees: Know the maximum payout limits and the cost per service call, which you pay whether the repair is covered or not.

When Homeowners Insurance or a Builder’s Warranty Might Pay for Stucco Damage

While asking do home warranties cover stucco rarely yields a positive answer, your other protection options are more promising. Homeowners insurance and a builder’s warranty are far more likely to cover stucco repairs, but only under specific circumstances.

Unlike home warranties, these policies deal with the actual structure of your home. However, the claim process can be complex, often involving adjusters and negotiations. Understanding when and how to file a claim is crucial for covering costly repairs.

Does Homeowners Insurance Cover Stucco Problems?: Does Homeowners Insurance Cover Stucco Problems?.

Homeowners Insurance: Coverage for “Perils,” Not Poor Workmanship

Homeowners insurance protects against unexpected disasters, not construction mistakes or wear and tear. This distinction is critical for stucco damage.

If a windstorm sends a tree crashing into your wall or a hailstorm pummels your home, you likely have a covered claim. The damage is sudden and accidental, caused by what insurers call “covered perils.” Fire and vandalism are other examples.

However, if an investigation finds the damage stems from gradual water intrusion due to poor installation or failed caulking, your claim will likely be denied as a maintenance issue. Similarly, mold exclusions are common. Mold caused by long-term moisture in your stucco system is typically not covered. The bottom line is that insurance covers accidents, not problems from poor construction or neglect.

Builder’s Warranty: Your First Line of Defense for New Homes

For a newly constructed home, your builder’s warranty is the strongest protection against stucco problems. It directly addresses issues from the construction process.

Workmanship standards and material defects are covered, usually for a 1-year warranty period. If your stucco was installed incorrectly, the builder is responsible for fixing it.

For major structural defects, coverage often extends up to 10 years. If improper stucco installation leads to significant water damage that compromises your home’s framing, it could fall under this extended coverage. Time is critical, as you are working against the Statute of Repose—a legal deadline for filing construction defect claims. Builder liability for these issues can be substantial, so act quickly if you suspect a problem.

For those in New Jersey, you can find additional guidance here: Consumer Information for New Home Buyers – NJ.gov.

Your Stucco Damage Action Plan: From Finding to Resolution

Finding stucco damage can be overwhelming. A systematic approach helps you understand the problem, assess its severity, and pursue claims effectively. Every step matters for protecting your investment.

Step 1: Document Everything and Assess the Damage

The moment you suspect damage, use your phone to take clear photos and videos from multiple angles. Detailed documentation is crucial for any future claim. Look for these common signs of failure:

- Cracks and separation: Especially larger, spiderweb, or horizontal cracks around windows and doors.

- Bulging or soft spots: Pressing gently on the stucco may reveal water trapped behind it.

- Water stains: Dark streaks or discoloration near windows, doors, and rooflines are classic signs of water intrusion.

- Interior signs of moisture: Check for musty odors, damp drywall, or mold spots on interior walls.

Document the date you first noticed the damage and track any changes. This record-keeping provides invaluable evidence. Water damage is often the most serious issue, and small cracks can lead to significant structural problems.

Moisture Problems with Stucco: Moisture Problems with Stucco.

Step 2: The Critical Role of a Professional Stucco Inspection

Next, get a professional stucco inspection. This is a specialized forensic process designed to uncover hidden problems. A certified inspector uses advanced techniques to find issues that are invisible on the surface.

- Forensic testing includes a visual inspection for installation flaws like improper flashing or missing weep screeds.

- Moisture mapping uses specialized meters to identify high moisture content within the wall system through small, discreet probe holes.

- Core sampling may be used to take small samples of the stucco and underlying materials to directly assess damage.

This professional inspection provides an independent, third-party report that serves as vital evidence for any insurance or builder’s warranty claim. At Stucco Safe, we specialize in these methods for homeowners in Southeastern PA, New Jersey, and Delaware. Our inspections range from $495 to $1595+, a minimal investment compared to potential remediation costs that can run into six figures.

Is a Stucco Inspection Worth It?: Is a Stucco Inspection Worth It?.

Step 3: Navigating the Claim and When to Call for Backup

With your documentation and inspection report, you can file your claim. Present your evidence clearly to your homeowners insurance or builder’s warranty provider. Be prepared for a lengthy process, as insurers often deny initial stucco claims, citing construction defects or gradual damage.

If your claim is denied, don’t give up. Appeal the decision and request a detailed explanation in writing. For complex claims or persistent denials, consider calling for backup:

- Public adjusters work on your behalf to negotiate with the insurer and help you get a fair settlement.

- Construction defect attorneys are crucial when damage is extensive and linked to faulty construction, especially if the builder is uncooperative.

Stucco moisture remediation is a complex repair process, making it essential to pursue all avenues for coverage.

Stucco Moisture Remediation: Stucco Moisture Remediation.

Frequently Asked Questions about Stucco Warranties and Insurance

Do home warranties cover stucco cracks?

Typically, no. Most home warranties exclude cosmetic issues, which is how they classify most cracks. They also won’t cover damage from poor installation or normal house settling, which are the root causes of many stucco problems.

Coverage for structural items like siding is extremely rare. Even if a policy mentions it, exclusions for improper installation, normal wear and tear, and pre-existing conditions will almost certainly prevent a successful claim. So, if you’re asking do home warranties cover stucco cracks, the answer is a firm no in nearly all cases.

Will my homeowners insurance pay for stucco water damage?

This depends entirely on the cause of the water damage. Insurance covers sudden, accidental damage. If a storm tears off your siding and rain soaks the stucco, it may be covered.

However, most stucco water damage is gradual. If water seeps in over months or years due to failed caulking, poor flashing, or improper installation, your claim will be denied. Insurance policies are designed for sudden disasters, not long-term maintenance issues or construction defects. The key distinction is sudden versus gradual damage.

More on insurance and stucco: More on insurance and stucco.

How long is a builder responsible for stucco problems?

For new homes, builder responsibility is tiered. For workmanship and material defects, which includes most stucco installation issues, builders are typically responsible for one year.

However, if the stucco failure leads to a major structural defect, such as rot in the home’s framing, the builder’s liability can extend for up to 10 years. This depends on your state’s laws and the specific terms of the warranty.

This extended coverage exists because serious structural damage from water intrusion can take years to become apparent. Be aware that most states have a “Statute of Repose,” which sets a final deadline for filing construction defect claims. If you are in a newer home and spot stucco issues, act quickly, as the clock is ticking.

Conclusion: Protecting Your Investment in Your Stucco Home

The answer to do home warranties cover stucco repairs is almost always a disappointing no. Home warranties are designed for appliances and systems, not the complex issues associated with a home’s structural envelope.

Your best chance for coverage lies with homeowners insurance for sudden perils like a storm, or a builder’s warranty for defects in a new home. A builder’s warranty offers the strongest protection, covering workmanship for one year and major structural defects for up to ten.

However, the real secret to protecting your investment is proactive assessment. Stucco failures often hide behind a normal-looking exterior while rot spreads silently. By the time you see obvious signs, the damage can be extensive.

A professional inspection by a certified company like Stucco Safe provides the clarity to identify issues early, prevent overwhelming expenses, and build a strong case for a claim. Our forensic testing methods are designed to uncover these hidden defects.

Our stucco inspections range from $495 to $1595+, a small price compared to remediation costs that can reach six figures. Don’t wait for a small crack to become a financial disaster. Taking action now can save you from overwhelming repair bills later.

Get peace of mind with a professional inspection for insurance coverage for stucco: Get peace of mind with a professional inspection for insurance coverage for stucco.