EIFS Home Insurance: 5 Steps to Secure

The EIFS Factor: Understanding Your Home Insurance

For many homeowners, securing eifs home insurance can be a source of worry. Insurance carriers have been known to threaten cancellation for homes with EIFS siding, a situation that isn’t uncommon. While EIFS offers excellent insulation, its early versions led to significant problems, causing many homeowners to face insurance challenges.

Here’s what you need to know about EIFS home insurance:

- What is it? It’s homeowner’s insurance for houses with Exterior Insulation and Finish Systems (EIFS), also known as “synthetic stucco.”

- Why is it difficult? Early EIFS versions trapped moisture, leading to rot, mold, and structural damage. Flammability concerns with the foam plastic also exist.

- Can you get coverage? Yes. Modern EIFS systems, known as “drainable EIFS,” are vastly improved.

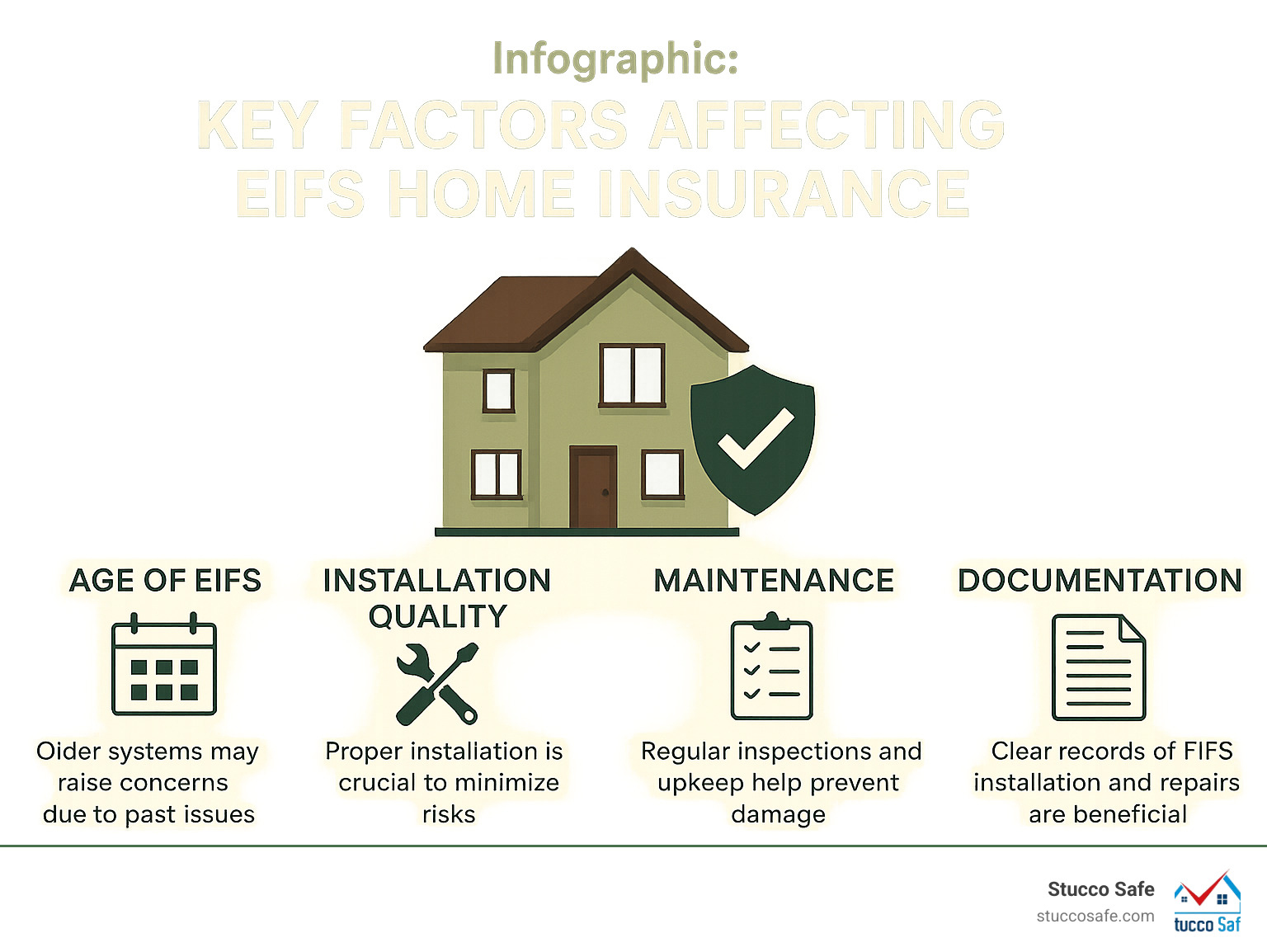

- How can you improve your chances? Proper installation, regular maintenance, and clear documentation are crucial.

I’m Gabe Kesslick, and for over two decades, I’ve specialized in building envelope issues. I help homeowners steer the complexities of eifs home insurance through expert stucco inspections and forensic analysis. This guide will walk you through everything you need to know.

What is EIFS and Why Is It an Insurance Risk?

EIFS, or Exterior Insulation and Finish Systems, is often called “synthetic stucco” for its similar appearance to traditional stucco. Used in the U.S. since the 1970s, it’s a multi-layered system designed for superior insulation and aesthetics.

The system typically includes:

- An insulation board: Usually expanded polystyrene (EPS) foam attached to the home’s exterior wall.

- A water-resistant base coat: Applied over the insulation and reinforced with fiberglass mesh.

- A finish coat: The visible, textured, and colored layer.

So why does EIFS create headaches for eifs home insurance? The problem lies with early ‘barrier EIFS.’ These systems were designed to be a complete seal, but this became a major flaw. If water penetrated through cracks or unsealed windows, it became trapped.

This trapped moisture led to severe issues:

- Water intrusion into wall cavities.

- Wood rot in the home’s structure.

- Mold and mildew growth in damp, dark spaces.

You can learn more about these issues in our resources on EIFS Moisture Problems and Synthetic Stucco Moisture Problems.

Beyond moisture, flammability was another concern. The foam plastics in EIFS can spread flames faster than wood, making insurers nervous about fire risk.

EIFS vs. Traditional Stucco

Understanding the difference between EIFS and traditional stucco is key to grasping the insurance challenges. Traditional stucco is a breathable, cement-based mix applied over a wire mesh (lath), allowing moisture to evaporate.

| Attribute | EIFS (Exterior Insulation and Finish Systems) | Traditional Stucco (Cement-based) |

|---|---|---|

| Composition | Multi-layered system: insulation board, reinforced base coat, synthetic finish coat. | Single or multi-layered cement-based mixture (lime, sand, water), applied over a lath. |

| Insulation | Excellent (continuous insulation layer). | Minimal to none (relies on wall cavity insulation). |

| Flexibility | More flexible; less prone to cracking from minor building movement. | More rigid; prone to cracking, especially with building settlement or expansion/contraction. |

| Weight | Lighter weight, putting less stress on the building’s structure. | Heavier, requiring more robust structural support. |

| Moisture | Early “barrier EIFS” trapped moisture; modern “drainable EIFS” includes drainage planes. | Naturally breathable and water vapor permeable; allows trapped moisture to evaporate. |

| Application | Applied directly to the sheathing. | Applied over a lath (wire mesh) and often a building paper/vapor barrier. |

| Appearance | Wide range of textures and colors, often smoother. | Typically rougher, more earthy textures; limited color palette. |

| Durability | Durable against impact in modern systems; can last 50+ years with proper care. | Very durable, but susceptible to cracking and can be brittle. |

The primary difference is water management. Traditional stucco breathes; early EIFS trapped moisture.

The History of Insurance Claims and Cancellations

The issues with early EIFS led to a crisis of widespread damage, especially in humid climates, resulting in lawsuits against builders and manufacturers. Faced with massive claims for high-cost repairs, insurance companies reacted by adding EIFS exclusions to policies.

This created significant problems for homeowners:

- Policy cancellations: Insurers often refused to cover homes with EIFS.

- Increased premiums: Coverage, if available, became much more expensive.

- High-risk classification: EIFS-clad homes were flagged, making insurance difficult to find.

This history of claims and legal battles left a lasting impression on the insurance industry, which still influences how EIFS homes are viewed today.

The Evolution of EIFS: From Problematic to High-Performance

The EIFS industry responded to early problems with significant research and development, resulting in a vastly improved product: modern EIFS, or ‘EIFS with Drainage.’

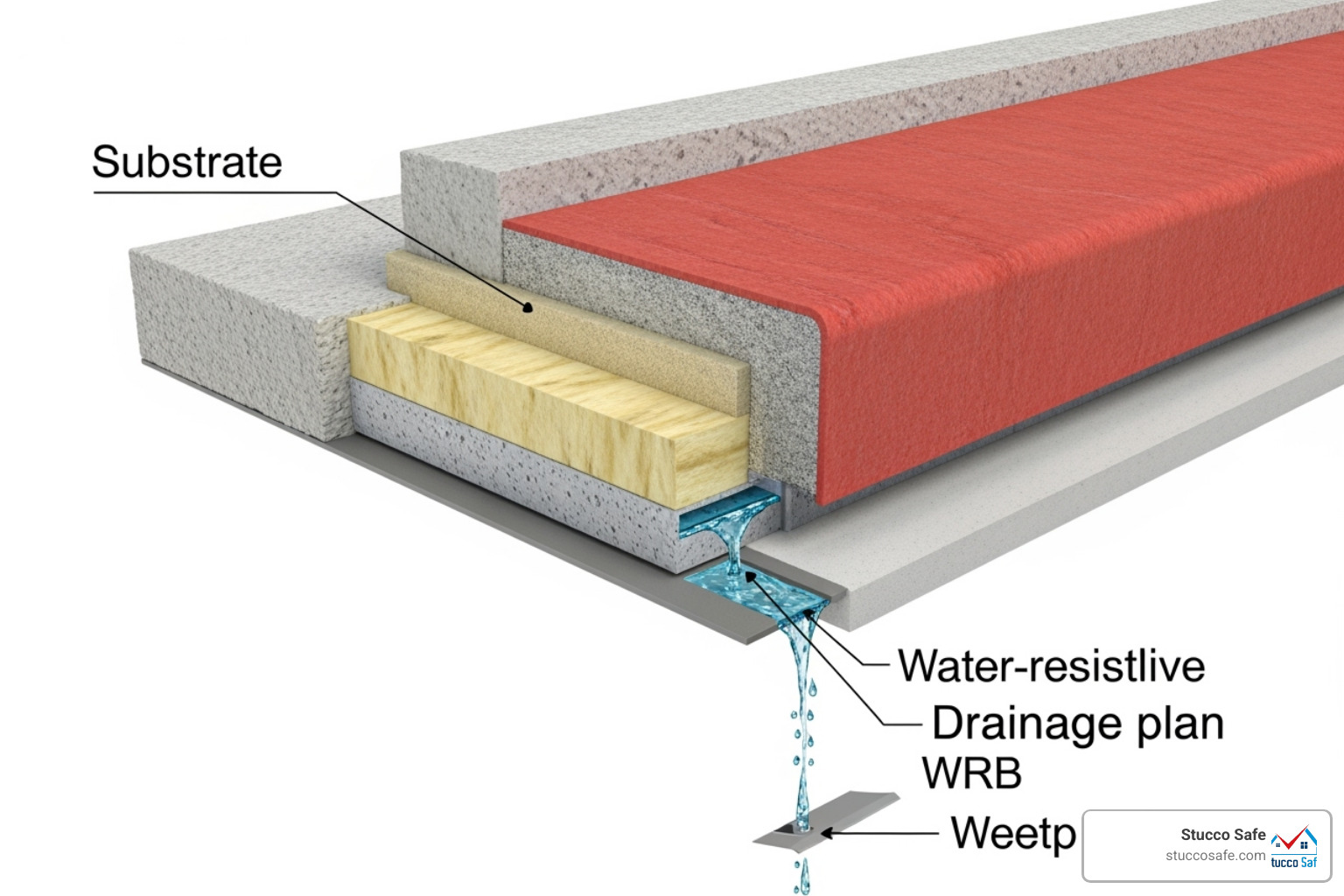

This new generation of EIFS directly addresses the moisture issue by incorporating a drainage plane. Instead of creating a sealed barrier, modern systems are designed to manage moisture by allowing any water that gets in to drain out.

Key improvements include:

-

Water-Resistive Barrier (WRB): An extra layer applied to the wall’s sheathing before the insulation board, acting as a shield against water.

-

Drainage Plane: A small space between the WRB and the insulation that allows water to drain down and out.

-

Weep Holes/Flashing: Strategically placed openings at the bottom of the wall and around windows that allow moisture to exit.

These innovations, along with better installation standards, have made EIFS a highly effective and durable cladding system. The industry has also improved fire resistance, with modern systems meeting strict safety codes like NFPA 285. With proper care, modern EIFS can last 50 years or more. Learn more about these advancements at Advancements in EIFS Cladding Systems.

How Modern Drainable EIFS Solves Past Problems

Drainable EIFS was a massive leap forward. By actively guiding water away, it prevents the conditions that caused past damage. This proactive approach significantly reduces the risk of:

- Moisture buildup inside walls.

- Mold and mildew growth.

- Wood rot and structural damage.

Beyond moisture control, modern EIFS offers other benefits:

- Air barriers that prevent air leaks and improve energy efficiency.

- Continuous insulation, which wraps the entire exterior to minimize heat loss. The U.S. Department of Energy has recognized EIFS for its effectiveness in keeping moisture out and heat in.

- Improved fire resistance features that meet current safety codes.

- Increased building durability due to superior moisture management.

When installed correctly, modern EIFS leads to a better-performing, more energy-efficient home with a longer lifespan. These features lower risks, which should translate to better eifs home insurance terms. For more on how moisture intrusion is now handled, see Moisture Intrusion Stucco.

Decoding Your Policy: EIFS Home Insurance Coverage & Exclusions

Despite advancements in EIFS technology, its past reputation means navigating eifs home insurance can be tricky. Insurers often use broad policy language and exclusions that don’t distinguish between old barrier EIFS and modern drainable systems.

When reviewing your policy, pay close attention to the fine print. Your policy defines covered perils (what is covered) and exclusions (what is not). EIFS-related exclusions are common. You may also see endorsements, which are amendments that can add or restrict coverage.

Standard homeowner’s insurance covers losses from fire, wind, and theft, but with EIFS, issues often arise from water damage, faulty workmanship, and lack of maintenance. Learn more about general coverage for stucco here: Does Homeowners Insurance Cover Stucco Problems?.

Common EIFS-Related Exclusions to Watch For

Insurers use EIFS exclusions due to the historical risks and high repair costs associated with moisture damage. Common exclusions include:

- Broad EIFS Exclusion: A blanket statement denying coverage for any damage related to EIFS, regardless of the system type or cause.

- Gradual Water Damage: Most policies exclude damage that occurs slowly over time, which is how many EIFS moisture issues develop.

- Mold and Rot: Policies often have specific limits or outright exclusions for mold and rot, which can result from gradual water damage.

- Pre-existing Conditions: Damage that existed before your policy began will likely be excluded.

- Defective Installation: Since many historical EIFS problems stemmed from improper installation, this is a significant exclusion.

- Wear and Tear / Lack of Maintenance: Damage resulting from failure to maintain the EIFS is typically not covered.

It’s crucial to understand your financial risks and coverage limitations. For a deeper dive, see Understanding EIFS Risks and Coverage Limitations.

Can Modern EIFS Improve Your EIFS Home Insurance Options?

Yes, modern EIFS can improve your eifs home insurance options and potentially lead to reduced premiums. While some underwriters are slow to adapt, proving your home has a high-performing, drainable EIFS system makes a significant difference.

Having modern EIFS helps by:

- Lowering your risk profile: A properly installed and maintained drainable system is less risky to insure, which can lead to reduced premiums.

- Offering potential discounts: Some insurers offer energy efficiency credits for the continuous insulation provided by modern EIFS.

- Proving system quality: Providing documentation of your drainable system, its installation specifications, and its compliance with building codes can help you get coverage and possibly remove EIFS exclusions.

Comprehensive documentation confirming your EIFS is in excellent condition is the key to overcoming underwriting challenges and securing favorable eifs home insurance terms.

Securing Coverage: A Homeowner’s Proactive Guide

As a homeowner, you can be proactive to improve your chances of securing and keeping solid eifs home insurance. Protecting your home’s EIFS requires a long-term commitment to proper installation, meticulous documentation, regular maintenance, and professional EIFS Inspections. These steps are vital for preventing claim denials. Learn more about the importance of inspections here: EIFS Inspections.

The Critical Role of Professional EIFS Inspections

At Stucco Safe, we know professional EIFS inspections are often essential for securing and maintaining eifs home insurance.

Our certified inspectors use forensic testing methods and tools like moisture meters to spot hidden damage and moisture deep within the wall system. Learn about our process at How Is A Stucco Moisture Test Done?.

A detailed inspection report from an expert like Stucco Safe provides invaluable evidence to your insurer that you are proactively maintaining your property. This can be a game-changer for obtaining coverage, removing exclusions, or supporting a claim. A pre-purchase inspection is essential when buying an EIFS home, while annual check-ups help existing owners catch small issues early.

Our inspection costs, starting from $495 to $1595+, are a small investment compared to the potential cost of undetected damage and claim denials. We specialize in finding moisture and structural issues for homeowners in Southeastern Pennsylvania, New Jersey, and Delaware.

Your Proactive Checklist for EIFS Home Insurance

Here is an actionable checklist for managing your eifs home insurance:

- Hire certified installers: Always choose professionals certified by the manufacturer to ensure the job is done right.

- Keep all installation and warranty documents: Maintain a file with contracts, warranties, and installer certifications.

- Schedule regular professional inspections: Have a certified inspector check your home annually or biennially to document its condition.

- Perform routine maintenance: Regularly check for cracks and stains, and ensure sealant and weep holes are intact and clear.

- Address minor damage immediately: Fix small cracks or holes quickly to prevent moisture intrusion.

- Document all repairs with photos and receipts: Keep detailed records of all maintenance and repairs.

Navigating an EIFS-Related Insurance Claim

If you need to file a claim, being prepared is crucial.

Proper documentation is your most important tool. Provide your insurer with installation records, maintenance logs, inspection reports, and photos. Before contacting your insurer, consider getting Certified Moisture Testing from an independent expert to provide objective proof that supports your claim. Learn more here: Certified Moisture Testing.

When working with your insurer, be cooperative and prompt. Using their approved contractors can streamline the process. Keep detailed records of all communications. If a serious dispute arises, you may need legal advice from an attorney specializing in insurance law.

Finding the Right Partner: EIFS-Knowledgeable Insurance Brokers

Finding the right eifs home insurance can feel like navigating a maze. A specialized insurance broker who understands modern EIFS can be an invaluable partner. Unlike generalists, they know which carriers are open to insuring EIFS homes.

A specialized broker offers:

- Deep Market Knowledge: They know which carriers welcome EIFS homes and understand the specific policies available for modern drainable systems.

- Access to Multiple Carriers: As independent agents, they can compare quotes from a wide range of providers to find the best fit for you.

- Expert Underwriting Navigation: They can help you present your home as a low-risk property to underwriters, providing the necessary documentation to secure coverage.

- Custom Policy Solutions: They can help tailor a policy to meet your home’s specific needs, ensuring appropriate coverage while minimizing exclusions.

The EIFS Industry Members Association (EIMA) is an excellent resource. Their EIMA Insurance Resource Hub connects homeowners with specialized insurance professionals and provides guidance on EIFS-related risk management.

List of Insurance Brokers with EIFS Expertise

According to the EIMA Insurance Resource Hub, these insurance brokers are recognized for their EIFS knowledge and are great starting points for finding comprehensive eifs home insurance:

- Brown & Brown Insurance

- Huckaby and Associates

- Filkins, Colbert & Associates, Inc.

- Ford Insurance Agency

- L&W Insurance

- Hull & Company, Inc.

- Weber Group Advisors

Conclusion

Securing eifs home insurance may seem complex, but it is entirely possible to get great coverage for your EIFS home. The key takeaway is that modern, drainable EIFS is a high-performance system that is energy-efficient, durable, and far superior at managing moisture than older versions.

However, the insurance industry can be slow to adapt. Therefore, homeowners must be proactive. This means ensuring your EIFS is properly installed, committing to careful maintenance, and scheduling regular professional inspections.

Professional inspections provide the clear information and documentation needed to protect your investment and steer insurance conversations. That’s what we do at Stucco Safe. Our certified stucco inspections and forensic testing give you peace of mind and the solid proof required to secure fair and comprehensive eifs home insurance in Southeastern PA, New Jersey, and Delaware.

Don’t let outdated stories about EIFS deter you. With the right knowledge and a proactive approach, your EIFS-clad home can be well-protected.

To learn more about insurance for stucco, visit our dedicated section: Learn more about insurance coverage for stucco.