Homeowners insurance stucco: 2025 Hidden Dangers

Why Stucco Insurance Coverage Matters More Than You Think

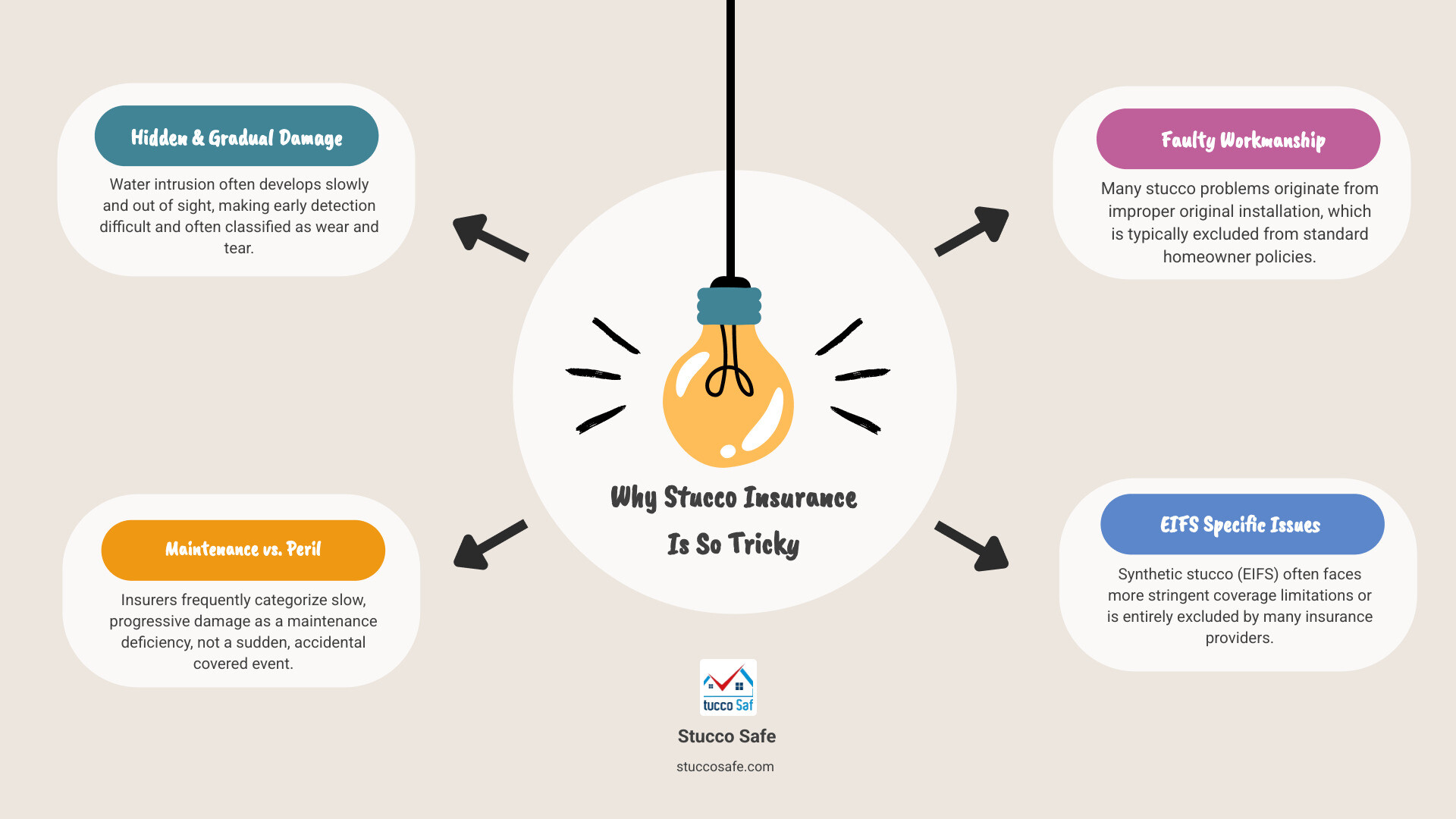

Homeowners insurance stucco coverage is complex. While some damage is covered, many claims are denied due to gradual water damage, construction defects, or maintenance issues.

Quick Answer: Does homeowners insurance cover stucco damage?

- ✅ Usually Covered: Storm damage, fire, hail, sudden water events

- ❌ Usually NOT Covered: Gradual water damage, poor installation, maintenance issues, EIFS problems

- ⚠️ Depends on Policy: Construction defects, pre-existing conditions, specific perils

Stucco homes are beautiful, but they can hide a costly secret: water seeping behind the exterior through tiny cracks, leading to repairs that can cost hundreds of thousands of dollars. Most homeowners assume their insurance will cover these issues, but they’re often wrong.

Stucco is tricky for insurance because the damage is often slow, hidden, and viewed as a maintenance problem. Poor installation from decades past and issues with synthetic stucco (EIFS) create further restrictions. This is a widespread issue; Toll Brothers alone estimates nearly $450 million in liabilities from stucco installation problems.

The bottom line: Coverage depends on what caused the damage and when it happened. A tree falling on your wall is likely covered. Water slowly seeping in over several years is almost certainly not.

I’m Gabe Kesslick, a certified stucco inspector with experience in leak detection since 2001. In hundreds of homeowners insurance stucco cases, I’ve seen how proper documentation and policy knowledge can prevent a costly denial.

Quick homeowners insurance stucco definitions:

Why Stucco is a Special Case for Insurance

Stucco is a popular exterior for its insulation, fire resistance, and distinctive charm. But for homeowners insurance stucco coverage, not all stucco is the same.

- Traditional stucco is a durable, cement-based material that is naturally “breathable,” helping moisture escape.

- EIFS (Exterior Insulation and Finish Systems), or synthetic stucco, is a newer, multi-layered system with foam insulation. It offers better insulation but has a history of moisture-related challenges. For more details, see our guide on EIFS home insurance.

Stucco is naturally porous, so it’s designed to let water in and out. The problem is that a huge number of stucco homes, particularly those built between 1993 and 2006, were not installed correctly. Critical components like drainage planes and flashing were often skipped, trapping water behind the stucco.

This trapped moisture leads to devastating, hidden consequences: hidden water damage rots your home’s wood structure, leading to wood rot, dangerous mold growth, and eventually, a loss of structural integrity. This reflects an industry-wide problem that leaves homeowners with the bill.

Understanding these vulnerabilities is crucial because insurance companies know these problems exist and write their policies to avoid covering them.

Signs of Stucco Damage to Watch For

Since stucco problems are often hidden, early detection is key to avoiding massive repair costs. Be a detective and look for these warning signs.

Exterior warning signs:

- Cracks: Especially spiderweb patterns or horizontal cracks around windows and doors.

- Dark stains: Greenish-black streaks (“stucco tears”) below windows indicate algae and moisture.

- Bubbles or blisters: Trapped moisture is causing the finish to separate from the wall.

- White, powdery deposits: Called efflorescence, this is a clear sign of water evaporating from the surface.

- Deterioration: Soft or crumbly stucco around windows, doors, and utility connections.

Interior red flags:

- Water stains or streaks on walls.

- Damp spots or musty odors, which often indicate hidden mold.

- Warped or rotted trim around windows and doors.

- Unexplained high humidity or increased pest activity (termites, carpenter ants).

As certified home inspector Blaine Illingworth notes about hidden damage in stucco homes, “stucco failures are often invisible on the surface.” By the time you see obvious signs, the damage is likely extensive. This is why professional inspections are so valuable.

The Core Issue: What Your Homeowners Insurance Stucco Policy Actually Covers

When it comes to homeowners insurance stucco damage, the answer to “Is it covered?” is almost always: “It depends.” This reflects the complex nature of stucco issues and insurance policy structures.

Most policies are either “named peril” (only covering damage from specific, listed events) or “all-peril” (covering damage from any cause unless it’s specifically excluded). All-peril policies seem broader, but their exclusion lists are long and often target common stucco problems.

The biggest hurdle is the distinction between sudden and accidental damage (usually covered) versus gradual damage (usually not). Insurance is for unforeseen events, but stucco damage often develops slowly from persistent moisture.

What’s Typically Covered

Your homeowners insurance stucco policy may cover damage from a “covered peril”—a sudden, unexpected event. These typically include:

- Fire and smoke

- Windstorms and hail

- Falling objects, like tree branches

- Vandalism

- Sudden and accidental water discharge (e.g., a burst pipe flooding through the stucco)

If the initial stucco damage is from a covered peril, your policy may also cover resulting interior damage as an “ensuing loss.” For example, if a hail storm punctures your stucco and rain gets in, the cost to repair both the stucco and the damaged interior drywall might be covered. Stucco Safe has helped policyholders recover compensation for entire stucco systems through ensuing water damage claims.

For more on how exterior components are covered, see our article on More on general siding insurance.

Common Exclusions: Why Stucco Claims Get Denied

This is where most claims fail. Insurance companies deny homeowners insurance stucco claims for specific reasons rooted in policy exclusions.

- Gradual Damage and Wear and Tear: This is the #1 reason for denial. Slow, continuous moisture seepage is considered a maintenance issue, not a sudden accident.

- Lack of Maintenance: If you neglected to seal cracks or clean gutters, leading to damage, your claim will likely be denied.

- Faulty Workmanship or Construction Defects: Policies do not cover damage caused by how the home was built. The liability falls on the builder or contractor, not the insurer.

- Pre-existing Conditions: Damage that existed before your policy began is not covered.

- Earth Movement: Damage from earthquakes, landslides, or foundation settling is excluded from standard policies.

- EIFS (Synthetic Stucco) Issues: Due to a history of moisture problems, many insurers refuse to cover EIFS or have very strict requirements.

- DIY Jobs Gone Bad: Damage resulting from work done by an unlicensed individual will likely be denied.

Understanding these exclusions is critical, as many homeowners are left with huge repair bills they assumed were covered. Learn more in our guide on More on stucco insurance problems.

Your Step-by-Step Guide to a Stucco Damage Claim

Finding stucco damage is overwhelming, but a systematic approach can make the difference between a successful claim and a denial. Follow these steps for the best outcome.

Step 1: Find and Document

Before you do anything else, become a detective. Your documentation is your lifeline when filing a homeowners insurance stucco claim.

- Take photos and videos of everything. Get wide shots of the affected area and close-ups of cracks, stains, or bubbles. Photograph any interior signs as well. Use a date stamp if possible.

- Note dates and observations. When did you first notice the damage? Did it appear after a storm? Details matter.

- Gather contractor records for any previous stucco work. Old invoices and warranties can be crucial.

Step 2: Mitigate Further Damage

Your policy requires you to prevent additional damage, but this means temporary fixes, not major repairs. Cover a leaking crack with plastic sheeting and waterproof tape. Redirect overflowing gutters. The goal is to stop the problem from getting worse while your claim is processed.

Step 3: Get a Professional Inspection

This step is critical. You need a specialist who understands homeowners insurance stucco issues. At Stucco Safe, our certified inspectors use forensic testing to find what’s hidden. We perform moisture testing by drilling tiny holes and inserting moisture meters into the wood sheathing behind the stucco. This reveals hidden water damage.

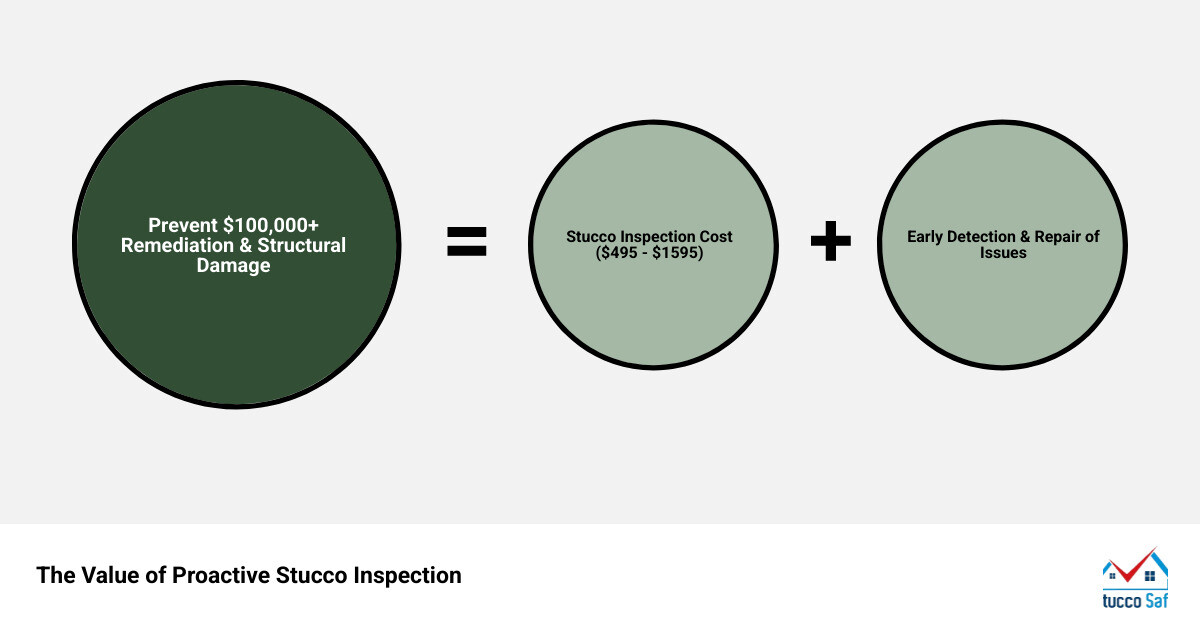

Crucially, we provide a root cause analysis. Insurers need to know why the damage happened. Was it a sudden storm (potentially covered) or gradual intrusion from poor installation (likely not)? This analysis is often the deciding factor. A professional inspection costs between $495 and $1,595, an investment that can pay for itself many times over by securing a covered claim.

Learn more about what to expect from a stucco inspection.

Step 4: Review Your Policy & Contact Your Insurer

Before calling your insurer, read your homeowners insurance stucco policy. Understand your coverage limits, deductibles, and exclusions, especially sections on water damage and construction defects. When you call, you’ll be prepared. Report the damage promptly and be ready to provide your documentation and professional inspection report.

What If Your Homeowners Insurance Stucco Claim is Denied?

A denial isn’t always the final word. Here’s what to do:

- Understand the denial letter: Insurers must state the exact reason and policy language used for the denial.

- Appeal the decision: Your professional inspection report provides the forensic evidence needed to challenge the initial finding. A different adjuster with better documentation may reach a different conclusion.

- Consider a public adjuster: For large claims, these professionals work for you (not the insurer) to negotiate a better settlement. They typically work on contingency.

- Pursue builder liability: If the damage is from faulty construction, you may need to file a claim against the builder. Be aware of your state’s statutes of repose, which are legal deadlines for suing builders. In Florida, for example, the limit is generally ten years.

Proactive Measures: Protecting Your Home and Your Coverage

Protecting your home from stucco damage is like car maintenance—regular upkeep prevents major breakdowns. For homeowners insurance stucco coverage, this proactive approach is essential.

Regular maintenance is your first line of defense. Promptly seal cracks with elastomeric caulk. Annually check caulking around windows, doors, and utility penetrations, as these are prime spots for water intrusion. Clean gutters and ensure downspouts direct water at least six feet from your foundation. Finally, trim vegetation away from walls to allow your stucco to breathe.

Professional inspections are the most crucial step. Since stucco failures are hidden, only forensic testing can reveal what’s happening inside your walls. At Stucco Safe, we recommend periodic checks every two years, especially for homes built between 1993 and 2006. A stucco inspection costs between $495 to $1,595 or more for very large homes, a small price to pay to avoid six-figure remediation costs.

Early detection leads to smaller repairs and shows your insurer you’re a responsible homeowner. Don’t wait for visible signs of damage; Schedule a professional stucco inspection to know where you stand.

Choosing the Right Homeowners Insurance for Stucco

When shopping for homeowners insurance stucco coverage, ask specific questions. Don’t accept a generic “yes, we cover your home.”

- Ask about exclusions for gradual water damage, mold, and faulty workmanship.

- Be upfront if you have EIFS (synthetic stucco) and ask about their requirements.

- Inquire about policy endorsements (add-ons) for extra water or mold coverage.

- Choose a deductible you can comfortably afford.

- If buying a stucco home, make a specialized stucco inspection a condition of your purchase to protect yourself from inheriting problems.

Frequently Asked Questions about Homeowners Insurance and Stucco

Homeowners often feel lost when it comes to homeowners insurance stucco coverage. Here are answers to the most common questions we receive at Stucco Safe.

Can I get insurance for a house with EIFS (synthetic stucco)?

It’s challenging. Due to a history of widespread moisture problems in the 1980s and 1990s, many insurers are wary of EIFS.

- Many insurers will refuse to cover EIFS homes, viewing the risk as too high.

- Those that do offer coverage will likely require a drainable EIFS system, which allows trapped moisture to escape.

- They will almost certainly demand a specialized EIFS inspection before issuing a policy.

Our forensic testing and system evaluation provide the detailed analysis that insurers require to make a decision, assessing the EIFS system’s integrity and checking for hidden moisture.

Does insurance cover mold from a stucco leak?

Coverage for mold is frustratingly complex. The key factor is the source of the moisture.

- Mold from a sudden, covered event (like a storm-damaged wall) might be covered as an “ensuing loss.”

- Mold from gradual moisture intrusion is almost certainly excluded, as it’s considered a maintenance issue.

Even when mold is covered, most policies have low sub-limits (e.g., $10,000), which may not be enough for full remediation. Prevention is your best defense against mold.

Is damage from a bad installation job ever covered?

Almost never. Standard homeowners insurance policies specifically exclude damage from faulty workmanship or construction defects. Insurance is designed to cover accidents, not to act as a warranty for a contractor’s poor work.

If your stucco problems stem from a botched installation, the liability falls on the builder or contractor. You must pursue them directly. This is why it’s critical to be aware of your state’s Statute of Repose, which limits how long you have to sue a builder for defects.

This reality underscores the importance of hiring licensed, reputable contractors and getting detailed inspection reports, which provide the forensic evidence needed to pursue a liability claim. Your homeowners insurance stucco policy is not a safety net for bad construction.

Conclusion

After years of navigating homeowners insurance stucco claims, I’ve learned that knowledge is your best defense. The most important takeaway is this: coverage depends entirely on the cause of the damage. A sudden storm is likely covered; slow seepage from poor installation is not.

Because stucco damage is often hidden, you may not see a problem until it’s already extensive and expensive. This is why proactive maintenance and professional inspections are essential.

Spending $495 to $1595 on a professional stucco inspection is an investment in protecting your home. Our forensic testing at Stucco Safe can find moisture problems years before they become visible, saving you from six-figure repairs that insurance won’t cover.

Don’t assume you’re covered. Read your policy, ask your insurer specific questions, and look for the warning signs we’ve discussed. If you’re in Southeastern Pennsylvania, New Jersey, or Delaware, we can help you understand what’s really happening behind your walls.

For a comprehensive understanding of your home’s stucco and potential insurance risks, explore our resources on insurance coverage for stucco. Your wallet will thank you.