How to get stucco damage covered by homeowners insurance 2025

Why Most Stucco Damage Claims Get Denied (And How to Beat the Odds)

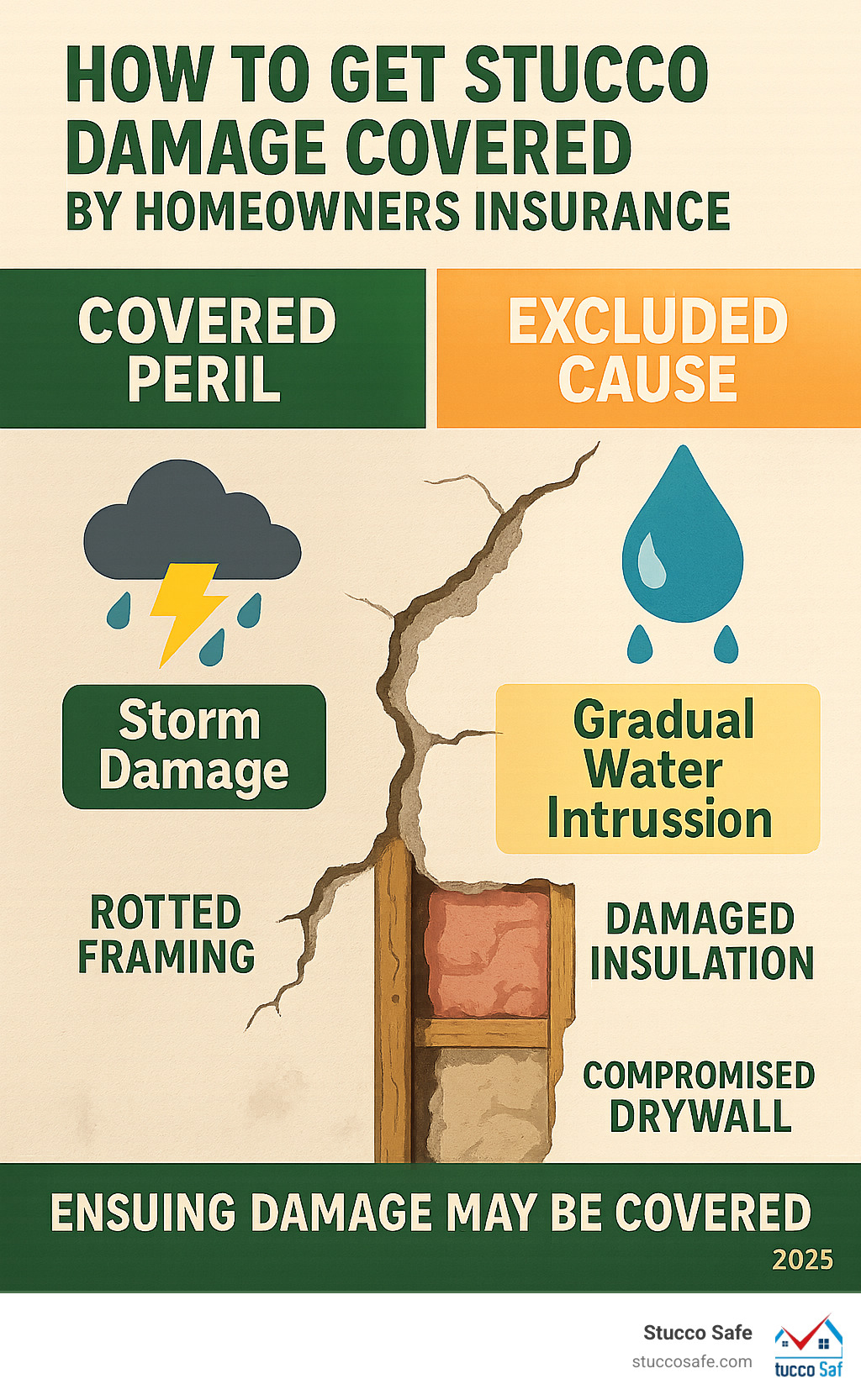

How to get stucco damage covered by homeowners insurance depends on proving the damage resulted from a covered peril, not poor maintenance or faulty installation. The reality is that most stucco claims are denied initially because insurers often point to construction defects or maintenance issues. However, you can beat the odds.

Essential Steps for Coverage:

- Document everything – Take detailed photos and videos of all damage.

- Get a professional inspection – Hire a certified stucco inspector ($495-$1,595).

- Prove the cause – Link the damage to a specific event like a storm.

- File promptly – Contact your insurer as soon as you find the issue.

- Focus on “ensuing loss” – Highlight covered damage like rotted framing or insulation that results from the initial problem.

Success hinges on focusing on the ensuing damage rather than the stucco itself. As a certified forensic building envelope inspector, I’ve seen that the key to getting a claim approved is proving what caused the damage, not just documenting what’s visible on the surface. Proper documentation and expert analysis are crucial.

Similar topics to how to get stucco damage covered by homeowners insurance:

Understanding Your Policy: What Stucco Damage Is Typically Covered?

Your homeowners insurance is a safety net for unexpected disasters, not a maintenance plan. It covers sudden and accidental damage from specific events called covered perils. It generally does not cover gradual damage that happens slowly over months or years.

This distinction is critical for stucco claims. The insurer will always ask: “What caused this damage, and when did it happen?” For example, water damage from a sudden pipe burst is typically covered. But if water has been slowly seeping behind your stucco for years due to poor installation, most insurers will call that a maintenance issue and deny the claim. As a certified home inspector explains the dangers of hidden water damage, many stucco issues develop silently, making them challenging for insurance claims.

Covered Perils: When Insurance Is Likely to Help

When stucco damage happens suddenly from an outside force, you’re much more likely to get coverage. These are the scenarios where insurance companies typically say “yes”:

- Storms, Wind, and Hail: High winds can tear off stucco, while hail leaves clear impact marks that are hard to dispute.

- Fire and Falling Objects: Damage from a fire or a tree branch crashing into your home is almost always covered.

- Vandalism: If someone deliberately damages your stucco, it falls squarely under most policies.

- Sudden Pipe Bursts: Water damage to the stucco system from an abrupt pipe failure is usually covered. The key word is “sudden.”

In these cases, the damage is immediate and caused by something beyond your control, which is what insurance is designed for.

Common Exclusions: Why Most Stucco Claims Are Denied

Unfortunately, most real-world stucco problems don’t fit neatly into the “sudden accident” category. Here’s why insurers frequently deny stucco claims:

- Faulty Workmanship: If your stucco wasn’t installed correctly (e.g., missing flashing, improper mix), the insurer won’t pay to fix the contractor’s mistakes. This is especially true for unpermitted or DIY stucco work.

- Lack of Maintenance & Wear and Tear: Stucco needs upkeep. If you let small cracks go unsealed, the insurer will likely blame neglect.

- Gradual Water Intrusion: This is the most frustrating exclusion. Even if slow water entry causes thousands in rot, most policies won’t cover it because it wasn’t sudden.

- Other Exclusions: Earth movement, foundation settling, and pest infestation are also typically excluded from standard policies.

The “Ensuing Loss” Clause: A Potential Path to Coverage

Here’s where many homeowners find hope. Most policies include an ensuing loss clause, which may be your best shot at getting coverage.

The concept is simple: even if the initial cause of damage is excluded, the resulting damage might be covered. For example, faulty installation (excluded) allows rainwater (a covered peril) to get behind your stucco and rot the wooden framing. While the stucco repair might be denied, the rotted framing could qualify as ensuing loss.

This is how we help homeowners recover compensation. We focus on the covered cause of loss (like rainwater) and the resulting structural rot, insulation damage, and drywall damage. The policy language is critical here. You must prove that a covered peril caused the interior problems, shifting the focus from the defective stucco to the covered damage that resulted. This approach requires careful documentation and professional analysis but is often the key to a successful claim.

The First Steps: What to Do When You Find Stucco Damage

Finding stucco damage can be alarming, as it often signals deeper, more expensive problems. Taking the right steps immediately can make all the difference in how to get stucco damage covered by homeowners insurance.

When you spot a crack, bubble, or stain, your action plan should center on two things: thorough documentation and a professional assessment. The clock starts ticking the moment you find damage, so acting promptly is crucial.

Step 1: Document Everything Carefully

Your insurance claim will live or die based on the evidence you provide. Think of yourself as a detective.

- Photographic and Video Evidence: Use high-resolution photos and videos. Take close-ups of every crack and stain, plus wider shots to show context. If you see interior issues like water stains or warped drywall, document those as well—they are key evidence of “ensuing loss.”

- Written Log: Keep a detailed log. Note when you first saw each issue, the weather conditions, and how the damage has changed. Dates and times are critical for establishing a timeline.

Step 2: Get a Professional Stucco Inspection

Your observations are important, but insurers want an expert opinion. You need a certified inspector who specializes in stucco systems, not a general home inspector.

At Stucco Safe, our inspectors use professional-grade equipment for moisture testing to measure moisture levels behind your stucco. This forensic analysis helps determine the root cause of the damage—was it improper flashing, missing drainage, or something else? This is essential for distinguishing between covered and excluded causes.

You’ll receive a comprehensive damage assessment report with photos, moisture readings, and professional recommendations. This report is the objective, expert evidence that adjusters take seriously. Inspection costs ($495 to $1595) are an investment in your claim’s success, minimal compared to the potential repair costs you could recover.

Step 3: Review Your Homeowners Insurance Policy

Before calling your insurer, read your policy. It’s tedious but essential.

- Declarations Page: This summarizes your coverage limits, deductibles, and policy type.

- Exclusions: Pay close attention to the specific exclusions for water damage, mold, and faulty workmanship.

- Riders: Check for any water damage riders or special endorsements that might provide extra coverage.

Understanding your policy puts you in a stronger negotiating position.

Step 4: File Your Claim Promptly

Once you have your documentation and inspection report, contact your insurance company immediately. Delays can hurt your case.

When you call, you’ll start the claim filing process. Be ready to provide your documentation and inspection report. An insurance adjuster will be assigned to your case. Walk them through your findings and provide all your evidence. Be sure to get a claim number for all future reference.

How to Get Stucco Damage Covered by Homeowners Insurance: Building Your Case

After the initial steps, you must strategically prove your damage should be covered. It’s not enough to say “my stucco is damaged”—you need to tell a complete story with evidence that demonstrates liability.

This phase is about proving why the damage occurred. Was it a sudden storm (likely covered) or a long-standing construction defect (likely not)? Linking the cause to a covered peril is what makes or breaks a claim.

The Critical Role of Installation Quality and Contractor Licensing

The quality of the original stucco installation can determine your claim’s outcome. If a licensed contractor did the work according to building codes and manufacturer specifications, you’re in a good position. However, if the work was done by unlicensed professionals or as a DIY stucco project, your claim faces an uphill battle. Insurers argue they aren’t responsible for covering problems caused by unqualified work.

Is the Builder or Contractor at Fault?

If your insurer points to faulty workmanship, liability might shift to the original builder or contractor. This can open an alternative path for compensation.

- Builder Liability: If your home is relatively new, the builder may be legally responsible for construction defects.

- Contractor’s Insurance: The contractor’s insurance policy might cover the damages from their faulty work.

- Home Warranties: Check any warranties you have, as they often cover structural issues from defective construction.

Time is critical. The Statute of Repose in your state limits how long you have to file construction defect claims (often ten years). If negotiations fail, you may need legal recourse through a construction defect attorney.

Crucial Documentation for Your Stucco Damage Claim

Your documentation package must be comprehensive and compelling. Here’s what you need:

- Professional Inspection Report: This is your star witness. Our detailed reports identify the root cause and full extent of the damage, providing the objective expert opinion that adjusters respect.

- Photos and Videos: Continue documenting the damage progression to clearly link exterior issues to interior problems.

- Repair Estimates: Get detailed, itemized estimates from at least two reputable stucco remediation contractors to establish the financial scope of your claim.

- Home Maintenance Records: Proof of routine upkeep helps counter claims of neglect.

- Warranties: Any builder or contractor warranties are crucial if liability shifts to the installer.

- Communication Log: Keep a detailed record of all communication with your insurance company.

Navigating Claim Denials and Disputes

Getting a denial letter is frustrating, but it’s not the final word. Most stucco claims get denied initially. Insurers often start with a blanket denial, classifying problems as construction defects or maintenance issues. Think of this not as a final verdict, but as an opening move in a negotiation.

A denial, partial coverage, or a lowball offer can be challenged. With patience, persistence, and compelling evidence, many initially denied claims can be overturned.

My Stucco Claim Was Denied. Now What?

A denial letter is a roadmap for your appeal. It must state the specific reasons and cite the policy language used for the decision.

- Review the Denial Letter: Understand their exact reasoning, such as faulty workmanship or gradual water intrusion.

- Use the Appeals Process: You have a right to appeal. This is where your professional inspection report is critical. Use it to counter their reasoning, for example, by providing evidence of ensuing loss from a specific storm.

- Gather More Evidence: Depending on the denial, you may need a second expert opinion or more detailed repair estimates that separate covered from non-covered damage.

- Negotiate: An offer of partial settlement is an admission that some damage is covered. Use this as leverage to negotiate for more comprehensive coverage.

When to Hire a Public Adjuster vs. an Attorney

Sometimes you need a professional to level the playing field.

-

A Public Adjuster works for you, not the insurance company. They are experts in policy language and negotiating settlements. They are ideal when the dispute is about the scope of damage or the settlement amount. They typically work on contingency (10-15% of the settlement).

-

An Attorney is necessary for legal issues. This includes bad faith claims (when an insurer unreasonably denies a valid claim), complex policy disputes, or when you need to sue a third party like a builder for construction defects. They are essential when dealing with builder liability or if the insurer is not acting in good faith.

If your dispute is about the claim’s value, start with a public adjuster. If it involves legal liability or bad faith, you’ll likely need an attorney.

Frequently Asked Questions about Stucco Insurance Claims

When dealing with stucco damage, questions multiply quickly. Here are answers to the most common ones we hear.

Does homeowners insurance cover hairline cracks in stucco?

Probably not directly. Insurers view tiny hairline cracks as a maintenance issue and a cosmetic vs. structural problem. However, a crack can be a pathway for water intrusion. If that water causes ensuing loss (like rot or mold inside the walls), that resulting damage may be covered. The key is to monitor cracks and document any changes, especially after storms. The claim isn’t about the crack itself, but what the crack allows to happen.

What if the damage existed before I bought the house?

This is a tough situation. Insurance policies do not cover pre-existing conditions. If the damage was there when you bought the house, your claim will likely be denied. However, you may have other options:

- Seller’s Disclosure: If the previous owner knew about the problem and didn’t disclose it, you may have a legal claim against them.

- Home Inspector Liability: This is difficult to prove, as most general inspectors are not stucco specialists and their contracts limit liability.

This is why a specialized stucco inspection before you buy is so important. The cost of an inspection ($495 – $1,595) is a small price to pay to avoid tens of thousands in future repairs.

Are homes with EIFS (synthetic stucco) harder to get coverage for?

Yes, significantly. The EIFS history is plagued with widespread moisture retention issues from early systems that trapped water, causing catastrophic rot. This led to massive lawsuits and made insurers wary.

Today, insurer reluctance is still a major hurdle. Some companies won’t insure EIFS homes at all, while others charge higher premiums or require that the home has a modern drainable EIFS system. Expect mandatory moisture testing from a certified inspector before an insurer will even consider offering a policy. While newer EIFS is better, getting coverage requires rock-solid documentation and expert analysis to prove the system is sound.

Conclusion: Protecting Your Home and Investment

How to get stucco damage covered by homeowners insurance is a strategic process, not a matter of luck. Success hinges on a few key principles.

The cause matters more than the damage itself. Insurers cover sudden events, not gradual deterioration. Your best tool is often the “ensuing loss” clause, which covers resulting damage (like rotted framing) even if the initial cause (like faulty installation) is excluded.

Documentation is your lifeline. A clear, evidence-backed story with photos, records, and a professional inspection report is your strongest asset. Don’t be discouraged by an initial denial; it’s often just a starting point for negotiation.

Being proactive is your best defense. Regular inspections can catch problems early. If you’re in Southeastern Pennsylvania, New Jersey, or Delaware, our certified inspectors provide the forensic testing and detailed analysis that can make or break a claim. The investment in a professional inspection report ($495 to $1,595) is small compared to the tens of thousands in repairs it can help you get covered.

Your home is your largest investment. Protect it by understanding your policy, maintaining your property, and acting quickly with professional support when problems arise.