Stucco Insurance: Ultimate Protection 2025

Why Stucco Insurance Coverage Is More Complex Than Most Homeowners Realize

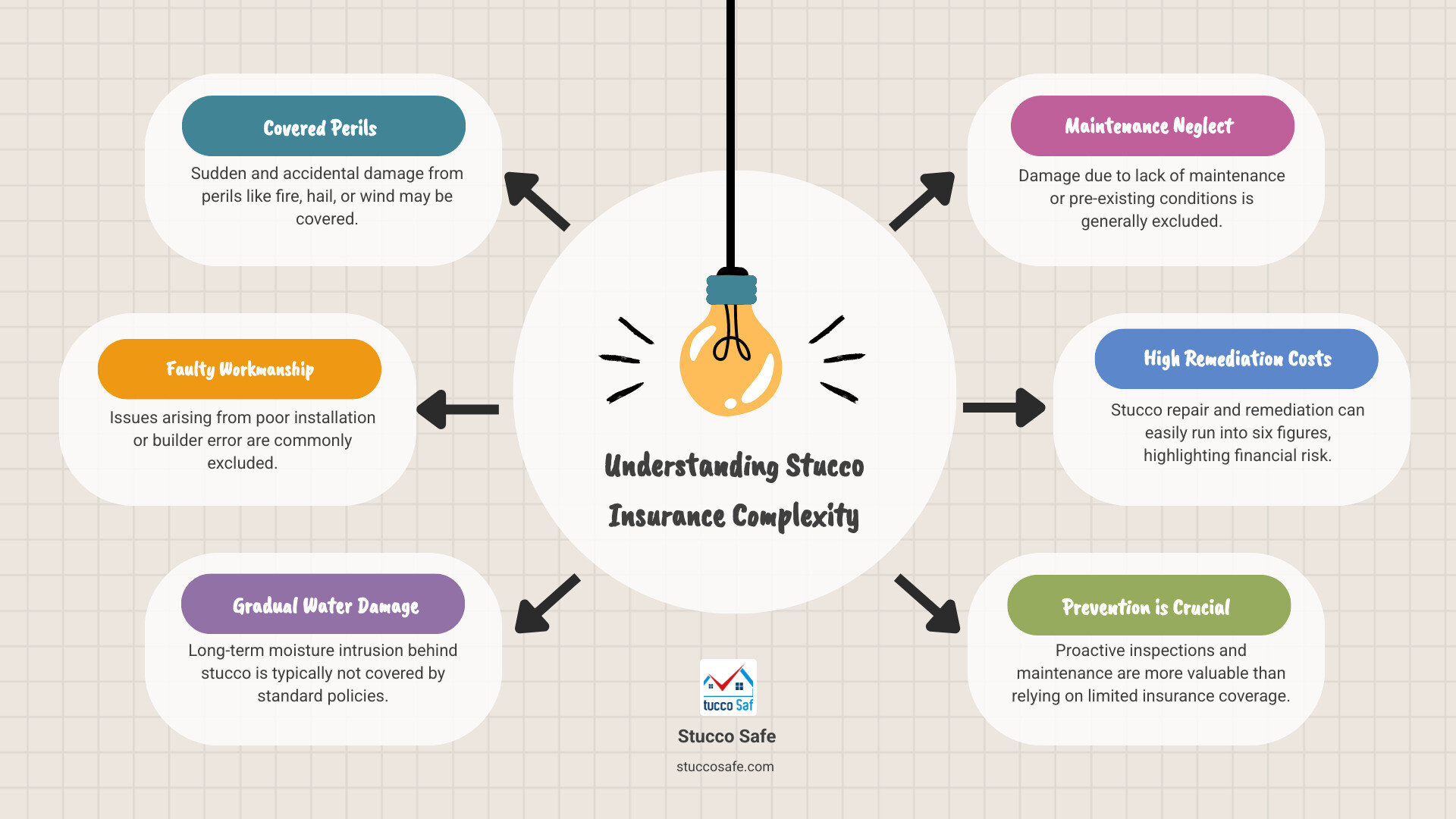

Stucco insurance is a complex topic that many homeowners don’t fully understand until they face water damage or structural issues. The challenge is that standard homeowners insurance policies often exclude the most common causes of stucco failure: poor installation, gradual water intrusion, and maintenance-related problems.

While a standard policy may cover sudden damage from events like fire, hail, or a burst pipe, it typically excludes faulty workmanship, gradual leaks, and pre-existing conditions. This leaves a significant coverage gap, as most stucco damage occurs slowly over time. With remediation costs easily running into six figures, this gap can be financially devastating.

This is why prevention through proper inspection and maintenance is far more valuable than relying on insurance to cover problems after they develop. Other potential avenues for coverage, such as a builder’s warranty or a contractor’s liability insurance, may exist but often have their own limitations.

As Gabe Kesslick, founder of Stucco Safe, I’ve investigated stucco failures since 2001. My experience with thousands of inspections has shown that understanding your coverage limitations upfront is the best way to avoid major financial surprises. We help homeowners steer these exact stucco insurance challenges.

Quick stucco insurance terms:

Understanding Stucco and Its Potential for Damage

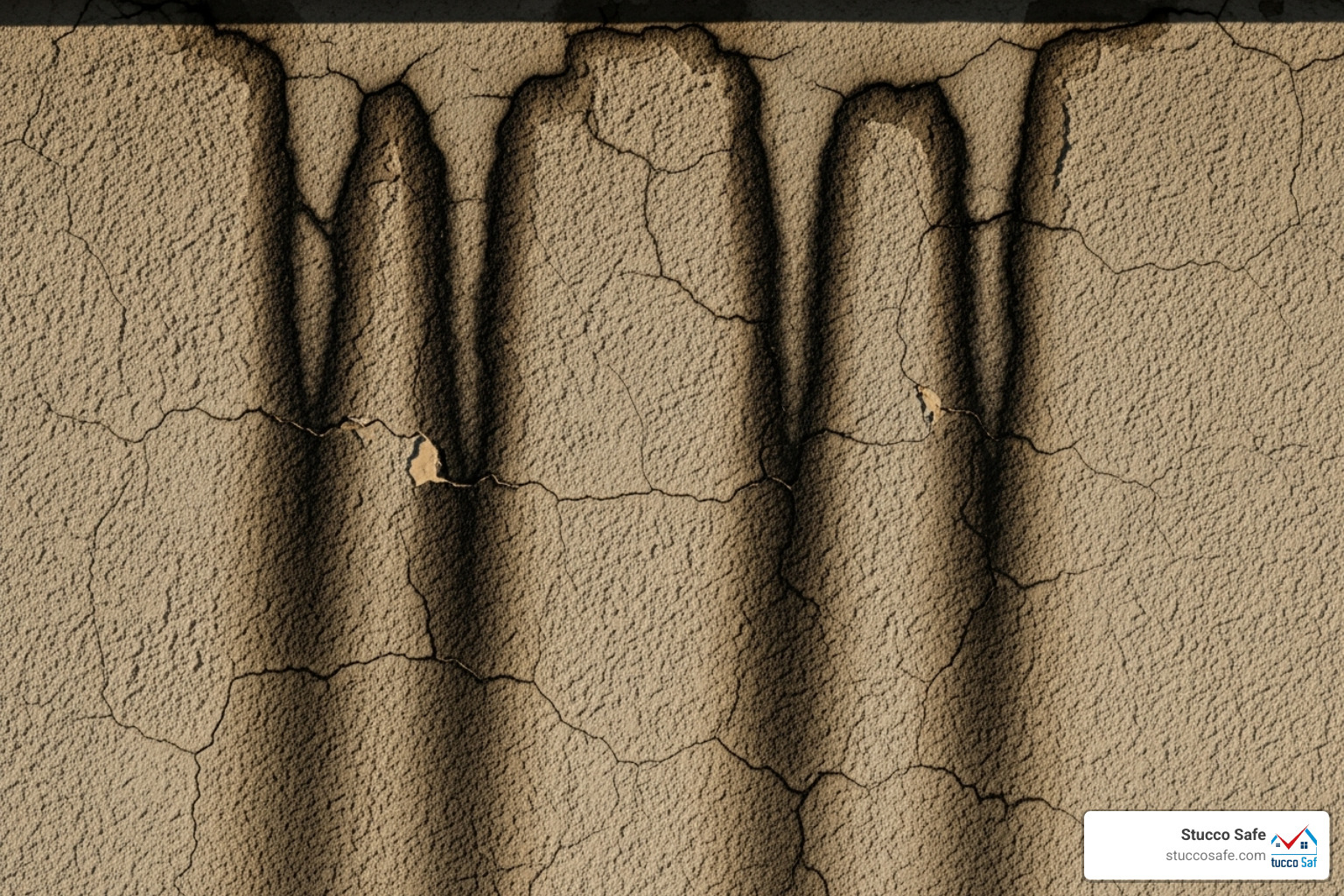

Modern stucco is a cement-based siding that is fire-resistant, a good insulator, and more affordable than brick or stone. However, its porous nature is where stucco insurance challenges begin. Stucco can absorb water, so proper installation is critical to prevent moisture from becoming trapped.

A correctly installed system includes key components to manage water: flashing around windows and doors to direct water away, weep screeds at the base to allow moisture to escape, and control joints to manage cracking. Unfortunately, many installations, particularly over the last 30 years, were done incorrectly, omitting these critical details. For more on these systemic issues, see our guide: Why Does Stucco Have Problems?

When water gets trapped behind stucco, it leads to a cascade of problems. Water damage soaks the underlying wood sheathing, causing wood rot that can compromise your home’s structural integrity. This damp, hidden environment is also a perfect breeding ground for mold growth. These issues often remain hidden for years, and by the time you see staining or feel damp spots, the damage can be extensive and expensive to fix.

The Difference Between Traditional Stucco and EIFS

Not all stucco is the same, which affects your stucco insurance options. The two main types are traditional stucco and EIFS.

Traditional stucco is a heavy, cement-based material applied over metal lath. It’s porous and relies on a complete drainage system to function correctly.

EIFS (Exterior Insulation and Finish System), or synthetic stucco, is a much lighter system applied over insulation boards. It’s more flexible and offers better insulation. The key difference is water management. While traditional stucco is designed to absorb and shed water, EIFS is more water-resistant on its surface. The catch is that if water gets behind an EIFS system, it can become trapped because the system doesn’t breathe as well. This higher risk perception makes some insurers hesitant to cover homes with EIFS, especially older, non-drainable systems. You may need a professional inspection before an insurer will provide coverage.

For more on how EIFS affects coverage, see our guide: EIFS Home Insurance.

Homeowners Insurance for Stucco: Coverage and Exclusions

Most homeowners have an HO-3 policy, which covers sudden and accidental damage from specific events, or perils. The good news is that if your stucco is damaged by a covered peril like fire, hail, or a falling tree, your stucco insurance will likely respond. If a pipe bursts inside a wall and damages the stucco, that’s also typically covered. The insurer’s goal is to restore your home to its pre-loss condition.

The challenge arises when the damage isn’t sudden. Most stucco insurance claims are denied because the failure is tied to installation or maintenance, which policies specifically exclude. For a general overview, check out: Does Home Insurance Cover Stucco?.

Key Exclusions in Homeowners Stucco Insurance Policies

Your policy almost certainly contains exclusions that block coverage for the most common types of stucco failure. Understanding these is critical.

- Faulty Workmanship and Poor Installation: If stucco fails because it was applied incorrectly (e.g., without proper flashing or weep screeds), the insurer will classify it as a construction defect, which is not covered.

- Gradual Water Damage and Lack of Maintenance: This is the biggest hurdle. Moisture that seeps in slowly over months or years due to unsealed cracks or deferred maintenance is not considered a sudden event and is therefore excluded.

- Pre-existing Conditions: Policies do not cover problems that existed before your coverage began. If you buy a home with hidden stucco damage, a later claim will likely be denied.

- Mold Limitations: While some policies offer limited mold coverage resulting from a covered peril (like a burst pipe), mold from gradual moisture intrusion is typically excluded or has very low coverage limits.

These exclusions create a significant coverage gap. As one insurance expert noted, “if water damage builds up over time, insurers may not be liable for the resulting damage.” This reality makes prevention and understanding your policy essential. For a deeper look at claim denials, visit: Does Homeowners Insurance Cover Stucco Problems?.

Navigating the Stucco Insurance Claim Process

Finding stucco damage can be overwhelming, but a methodical approach to the stucco insurance claim process can improve your chances of success. When you first spot a problem—like dark staining or cracks—your first step is to document everything with dated photos and videos. Prevent further damage if possible, but avoid permanent repairs before your insurer’s inspection.

Report the damage to your insurance company promptly. Be prepared for an initial denial, as this is common with stucco claims. Insurers often cite “construction defects” or “gradual water damage” as reasons for denial. This isn’t necessarily the end of the road.

A key concept that may help is “ensuing covered loss.” While the policy won’t cover the faulty workmanship itself, it might cover the resulting damage. For example, if rain (a covered peril) gets through improperly installed stucco and rots your wall framing, that ensuing damage could be covered. Unfortunately, this concept is often misapplied by adjusters. For more on these challenges, read: A Must Read Insurance Blog for Homeowners w/ Stucco.

When to Involve Professionals

Given the high rate of initial denials, professional help can be invaluable. Public adjusters, who work for you, can help document the claim and argue for coverage under provisions like ensuing loss. Insurance attorneys are essential if a claim is wrongfully denied or if you need to pursue legal action against the builder or contractor responsible for the faulty installation.

In many cases, the homebuilder who improperly installed the stucco is liable. If your home is new enough, you may have recourse through the builder’s warranty or their general liability insurance. However, states have a Statute of Repose that sets a time limit on how long you can file a claim against a builder after construction is complete. This makes early detection through a professional inspection critical to preserving your legal options.

The Role of Inspections in Securing and Claiming Stucco Insurance

For stucco insurance, a professional inspection is your most powerful tool. It can save you from buying a home with hidden damage and is often the key to winning a claim that would otherwise be denied. Many insurers now require a stucco inspection before issuing a policy, especially for homes with EIFS. An inspection before you buy can uncover a six-figure problem for a cost of around $495 to $1595, and it prevents a future claim from being denied as a “pre-existing condition.”

An inspection report provides the objective, forensic evidence needed to fight a claim denial. When an adjuster blames “poor maintenance,” concrete moisture readings and photographic evidence of hidden damage provide a powerful counterargument. For more on when an inspection is needed, see: Do I Need a Stucco Inspection?. The investment is small compared to potential remediation costs. For pricing, visit: Stucco Inspection Cost.

What a Professional Stucco Inspection Entails

A professional inspection is a forensic investigation to uncover hidden problems. The process starts with a comprehensive visual assessment, looking for cracks, stains, and improper installation details like missing flashing or weep screeds. The core of the inspection, however, is finding what you can’t see.

Using professional-grade moisture meters, we perform invasive testing. This involves drilling tiny 3/16-inch holes in strategic, inconspicuous locations to insert moisture probes directly into the wood substrate behind the stucco. This is the only definitive way to measure moisture and detect hidden rot, as thermal imaging is unreliable on stucco. After the investigation, you receive a detailed report with photos, moisture readings, and clear recommendations. This report is your roadmap for protecting your home and your best evidence for a stucco insurance claim.

Crucially, we do not perform repairs. This ensures our findings are completely unbiased, providing you with objective information to make informed decisions. For guidance on next steps if problems are found, see our: Stucco Remediation Guidelines.

Specialized Insurance for Stucco Professionals

While homeowners steer their policies, the professionals who install, repair, and inspect stucco require their own specialized stucco insurance. A single installation error can lead to six-figure damages years later, and job site accidents can be costly. Without proper coverage, these risks could easily put a contractor out of business.

Essential Insurance for Stucco and Plastering Businesses

Several types of insurance are essential for a stucco business:

- General liability insurance is the foundation, covering third-party injuries or property damage caused by your business operations.

- Workers’ compensation insurance is required in most states for businesses with employees, covering medical costs and lost wages for on-the-job injuries.

- Tools and equipment coverage protects the expensive, specialized gear that can be stolen from a job site or damaged in transit.

The cost of this insurance varies based on business size, location, and claims history. For more details on contractor coverage, you can explore Plastering and Stucco Work Insurance.

Errors & Omissions (E&O) for Stucco Inspectors

Stucco inspectors face a unique professional risk and need Errors and Omissions (E&O) insurance. This policy protects them if a client claims they made a mistake or missed a critical issue during an inspection. For example, if an inspector gives a home a clean bill of health but the owner later finds significant moisture damage, the inspector could face a lawsuit. E&O insurance covers the legal defense costs and any resulting settlement. This specialized coverage, often with limits of $100,000 or more, provides peace of mind for both the inspector and their client.

Frequently Asked Questions about Stucco Insurance

Homeowners with stucco problems often have the same urgent questions about their stucco insurance coverage. Here are answers to the most common ones we hear.

Does homeowners insurance cover cracks in stucco?

Coverage depends entirely on the cause. If cracks are from a sudden, covered event like a hail storm or a falling tree, your policy will likely cover the repair. However, most cracks develop gradually from normal house settling or poor installation. Insurers view this as a maintenance issue, which is the homeowner’s responsibility and is not covered.

Can I get insurance for a house with EIFS (synthetic stucco)?

Yes, but it can be challenging. Some insurers are wary of EIFS due to past issues with moisture intrusion. Carriers may refuse to cover older, non-drainable EIFS systems or may require a professional inspection before they will write a policy. A certified inspection report showing no active moisture problems is your best tool for securing coverage, though your premium may be higher than for other types of siding.

What should I do if my stucco damage claim is denied?

An initial denial is common but not always final. First, carefully read the denial letter to understand the specific reason, such as “faulty workmanship” or “gradual damage.” Next, get a forensic stucco inspection report if you don’t have one. This professional documentation provides the hard evidence needed to challenge the insurer’s findings. Finally, consider hiring a public adjuster or an attorney to help you steer the appeals process or pursue other parties, like the original builder.

Conclusion

Navigating stucco insurance is challenging because the most common and costly stucco problems—those stemming from faulty workmanship and gradual water damage—are typically excluded from standard homeowners’ policies. While insurance may cover sudden disasters like fire or hail, it often won’t cover the slow-moving water intrusion that leads to wood rot and mold.

This reality makes prevention and proactive measures your most powerful strategy. Regular maintenance and, most importantly, professional stucco inspections are your best defense against catastrophic, uncovered repairs. An inspection, which typically costs between $495 and $1595, can identify hidden moisture before it becomes a disaster. Furthermore, a detailed inspection report provides the critical evidence you need to challenge a wrongful claim denial and argue for coverage under “ensuing covered loss” provisions.

For homeowners in Southeastern Pennsylvania, New Jersey, and Delaware, understanding your stucco’s true condition is essential. At Stucco Safe, our forensic testing gives you the facts needed to protect your investment and make informed decisions about your home and your stucco insurance coverage. Don’t wait for visible signs of damage; by then, the costs may already be overwhelming.

For additional resources, visit our comprehensive guide: Insurance Coverage for Stucco.